It’s common for Americans to experience a sense of feeling like they’re

not setting aside enough money for retirement

– regardless of their age or financial status.

– irrespective of how old they are or how much money they make.

– without regard to their age or earnings.

– at all ages and income levels.

– whether young or old, rich or poor.

However, securing a larger paycheck can enable you to save more, provided you also raise your contributions as your earnings grow. Therefore, it’s hardly unexpected that employees with greater incomes often possess larger 401(k) account balances, according to

newly released data

owned by the investment management company Vanguard.

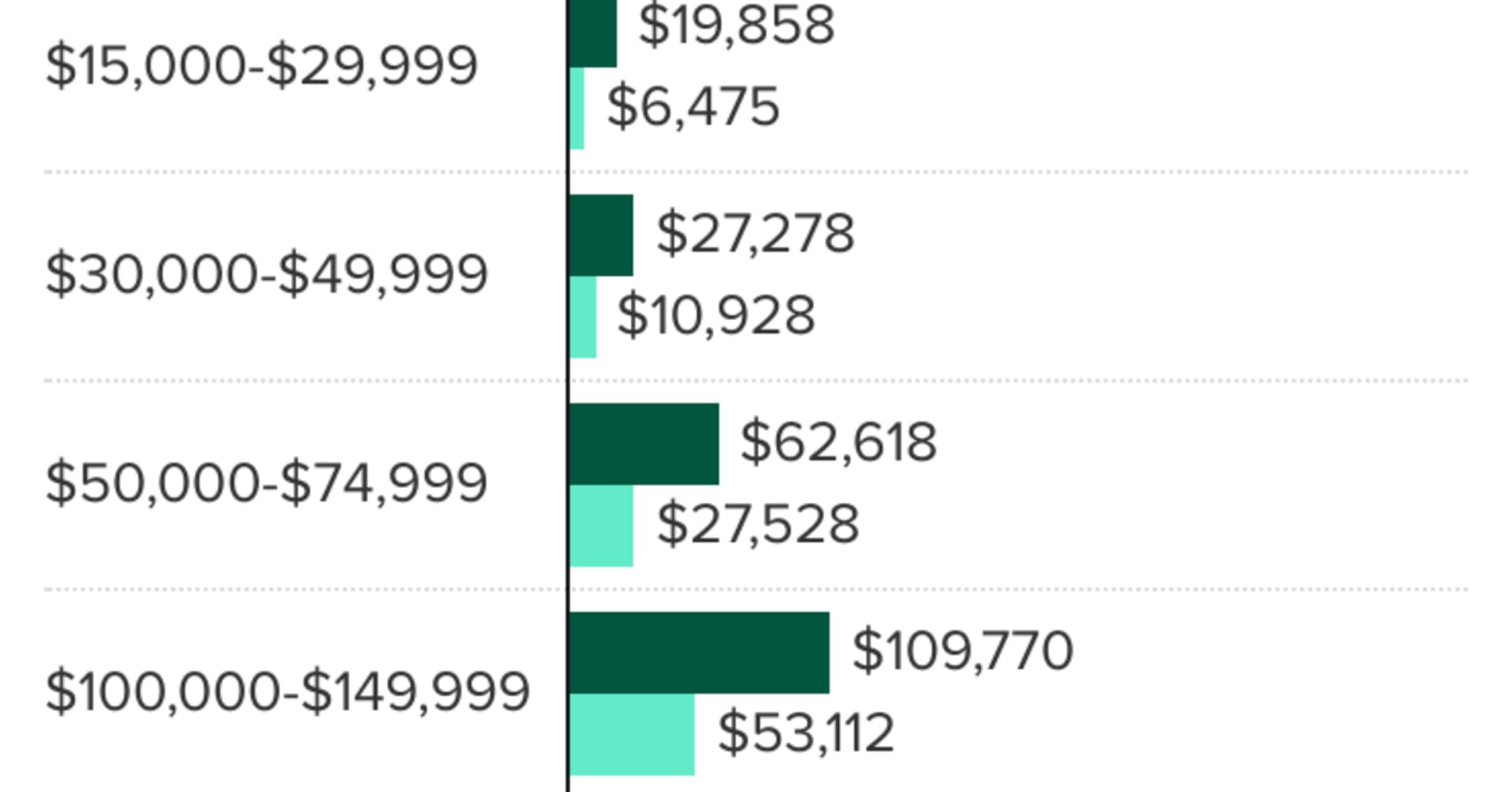

The typical savings amount in defined contribution accounts—such as 401(k) or 403(b) plans offered by employers—is almost twice as much for employees earning between $100,000 and $149,999 compared to those who earn between $50,000 and $74,999, according to Vanguard. The company analyzed information from approximately 5 million individuals enrolled in these types of retirement programs.

This is the amount employees have saved for retirement based on their income levels.

Significantly, the average balances are much greater compared to the median balances. While the median tends to be a better indicator, this is because averages may become distorted when just a few individuals have notably larger or smaller investment amounts.

Remember that these numbers reflect only the savings within Vanguard defined contribution plans. Investors might also have other retirement accounts with different plan administrators or independent brokerage accounts.

Americans are setting aside funds sooner and with greater regularity.

Despite ongoing

macroeconomic uncertainty

such as persistently elevated costs and

recession fears

Many U.S. citizens have focused on achieving their long-term financial objectives by contributing to retirement accounts.

Retirement saving habits have shown consistent annual improvement,” said David Stinnett, head of strategic retirement consulting at Vanguard, in an email to Make It. “It appears that, irrespective of market and economic circumstances, employees are

getting started saving earlier

saving a larger portion of their income, and regularly investing those savings in investment portfolios suited to their age.

No matter what their income level is, one key element that has contributed to increasing savings amounts is automatic enrollment. According to the same Vanguard research, employees who have been with their company for 10 years or longer and were automatically signed up for the retirement plan had median account balances about 60% greater than those who needed to actively choose to participate in contributions.

Auto-enrolled participants who had completed at least 10 years of service held a median balance of $192,372 in 2024, whereas those who enrolled voluntarily had a median amount of $121,094.

“Employers have made designing their 401(k) plans easier for employees to save and invest for retirement, and automatic enrollment plays a significant role in this,” Stinnett stated.

Are you prepared to purchase a home?

Enroll in “Take Smarter” with Make It’s latest online course

How to Purchase Your First House

. Experienced trainers will assist you in evaluating the expenses associated with leasing versus purchasing, get you ready financially, and guide you assuredly through each stage of the procedure—starting from understanding mortgages to finalizing the transaction.

Sign up today

and apply the promo code EARLYBIRD to get a special offer of 30% off $97 (plus taxes and fees) until July 15, 2025.

Plus,

Register for Make It’s newsletter

to discover advice and strategies for achieving success in your job, financial matters, and personal life, and

invitation to become part of our elite group on LinkedIn

to engage with professionals and colleagues.